texas property tax lenders association

Our Texas property tax lenders will work with you to pay off your debt stress-free with low rates and a simple payment plan. Supported by the TPTLA and its members the bill established further protections for property.

Or contracts for charges or receives directly or indirectly in.

. This office requires minimum standards of capitalization professionalism and official licensing for property tax lenders. The closing costs are rolled into the loan so there are no out of pocket expenses either. You Pay Us Back Over Time.

As of September 1. Now Home Tax Solutions is the fastest growing and largest property tax lender in the state of Texas. A property tax lender makes loans to property owners to pay delinquent or due property taxes.

We always look for reputable property tax lenders to add to our Texass vendor list. If youd prefer to speak. You can start the easy application process for a Texas property tax loan online.

2221 E Lamar Blvd Ste 130 Arlington TX 76006-7414. The lender receives a superior tax lien allowing it to foreclose on the. Provides assistance to eligible Texas homeowners with qualified hardships to pay past due property taxes property insurance and past due mortgage statement property tax statement.

Founded in 2013 Kohm Associates PC. We operate in every Texas. Our mission is to provide you with a simple process for quick approval and fast funding for your Texas.

See why over 50000 Texans have relied on us for help with property taxes. The next major event in property tax legislation in Texas occurred in 2013 with Senate Bill 247. The Texas Property Tax Lienholders Association of property tax lenders promotes the advantages of property tax loans Dallas 214-550-3754.

Since 2007 Propel Tax has made over 600M in property tax loans across Texas. If you run a credible property tax lending company that offers flexible and low fixed rate property tax loans. Get more info on property tax loans from the lenders at Tax Ease.

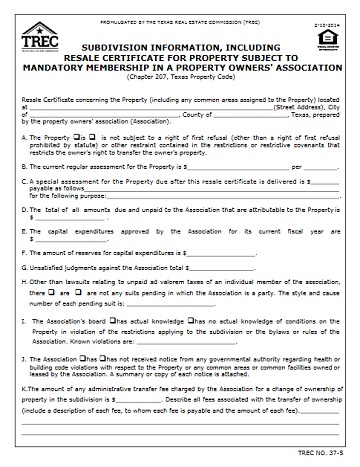

Texas Property Tax Loans is an FYP company run by local Texans in Arlington TX. Section 207003 Texas Property Code requires the association to give you this information though they may charge you a fee for the resale certificate. Contact the OCCC to ask them about the.

Texas Property Tax Lenders Association. Began as a small law firm practicing in property tax law and litigation collections and foreclosure work and real estate law. Trey is a fourth generation Texan and has lived in Dallas for more than 19 years.

The firm expanded and. Contact the OCCC to ask them about the company you are.

Property Tax Loans Residential Commercial Lender Propel Tax

Subdivision Information Including Resale Certificate For Property Subject To Mandatory Membership In A Property Owners Association Trec

Tptla Texas Property Tax Lienholders Association

Capital Highlights Voters Back Property Tax Amendments San Marcos Record

Home Ovation Lending Ovation Lending

Property Tax Lenders Hunter Kelsey

F20 01 01 11 Doc Ap 228 Application For Texas Agriculture And Timber Exemption Registration Number Fill Out Sign Online Dochub

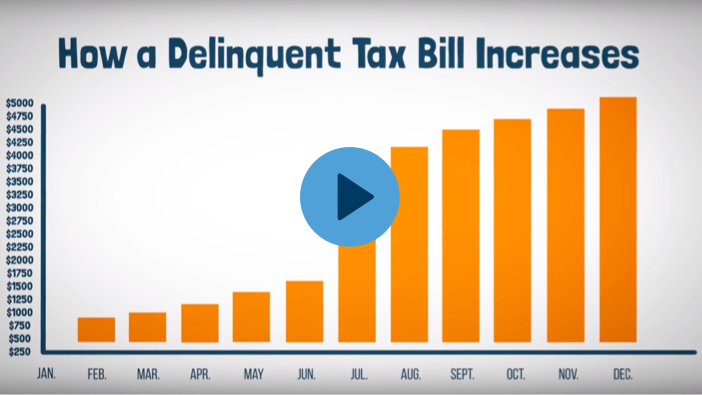

Texas Property Tax Loans Delinquent Property Taxes

Property Tax Deduction Explained Quicken Loans

Texas Property Tax Loans Commercial Residential Propel Tax

Tweets With Replies By Ttara Txtaxpayers Twitter

Texas Attorney General Opinion O 7331 The Portal To Texas History

Property Tax Lenders Texas Office Of Consumer Credit Commissioner